Indemnity -a sum of money paid as compensation. as definition found in google.

According to Dr Mubarak Al-Jafour Director of the Legal Affairs Department at the Manpower Public Authority ,that Labor Law 6/2010 accurately and clearly states the end of service indemnity for private sector workers.

Dr Jafour explained that a worker will receive one month salary for each year, for those who spent more than 10 years with the employer, while the indemnity should not exceed 18 months.

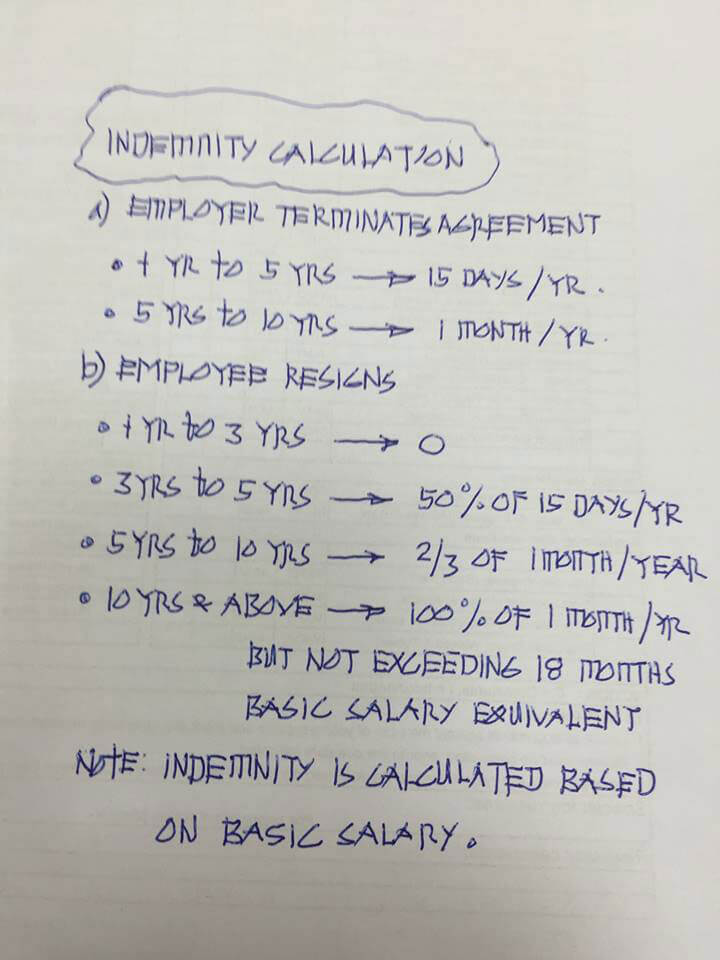

Indemnity is paid when the labor relation ends and is computed as follows:

- The worker who is paid on a daily basis deserves an indemnity of 10 days during the first five years, and increases to 15 days after five years of service.

- As for the worker who is paid monthly, the worker deserves 15 days indemnity during the first five years, and increases to one month after the first five years.

- An employee who resigns, but does not complete three years with the employer, does not deserve an indemnity.

- But if the employee completes three to five years and resigns, the employee then deserves half of the indemnity, if he completes five to 10 years, then he deserves two-thirds of the indemnity.

- If the worker completes 10 years of work then resigns, he deserves full indemnity which is one month salary for each year spent at work, according to Article 51 of Labor Law in the private sector, and should not exceed 18 months

Just saw one post from Bobby Bocoboc OFW in Kuwait which he summaries the calculation.

Kuwait Labor Law Mandates on the calculation of indemnity:

NOTE : INDEMNITY IS CALCULATED BASED ON BASIC SALARY!

Via Kuwaittimes

One blog has posted it long time on their Q&A Section with the sample on how is calculated

According to the Kuwait labor law. The worker shall be entitled to a 15 days remuneration for each of the first five years of service and one month remuneration for every year thereafter.

==========================================================

CASE 1:

If the employer terminates the contract or if the duration of the contract expired without being renewed then the worker should get full end of service benefit indemnity.

Example:

If you have worked for 10 years with 500 KD salary the end of service benefit indemnity is calculated as below.

1st five years 15 days x 5 = (75 days / 26 days) = 2.88 months.

Next five years 1 month x 5 = 5 months.

Total Months = 2.88 + 5 = 7.88 months

Total Service Benefit = 7.88 months x 500 KD = 3940 KD

==========================================================

CASE 2:

If the employee resigns after 3 to 5 years of service then the employee is entitled to get half of the end of service benefit indemnity.

Example:

If you resign and have worked for 4 years with 500 KD salary the end of service benefit indemnity is calculated as below.

Total months = 15 days x 4 = (60 days / 26 days) = 2.3 months.

Total Service Benefit = 2.3 months x 500 KD = 1150 KD / 2 = 575 KD

==========================================================

CASE 3:

If the employee resigns and worked more than 5 years and less than 10 years then the employee is entitled to 2/3 rd of the end of service benefit indemnity.

Example:

If you resign and have worked for 7 years with 500 KD salary the end of service benefit indemnity is calculated as below.

1st five years 15 days x 5 = (75 days / 26 days) = 2.88 months.

Next 2 years 1 month x 2 = 2 months.

Total Months = 2.88 + 2 = 4.88 months

Total Service Benefit = 4.88 months x 500 KD = 2440 KD x 2/3 = 1626.66 KD

==========================================================

CASE 4:

If the employee resigns and worked more than 10 years then the worker is entitled to get full end of service benefit indemnity.

Example:

If you resign and have worked for 13 years with 500 KD salary the end of service benefit indemnity is calculated as below.

1st five years 15 days x 5 = (75 days / 26 days) = 2.88 months.

Next 8 years 1 month x 8 = 8 months.

Total Months = 2.88 + 8 = 10.88 months

Total Service Benefit = 10.88 months x 500 KD = 5440 KD