Kuwait : Proposal to impose tax on the remittances of expatriates was summited on yesterday January 5,2017 Thursday by MP Faisal Al-Kandari

Article 1: Stipulates imposing tax on money that expatriates send outside Kuwait.

Article 2: States that the remittance tax must go to the State’s coffers.

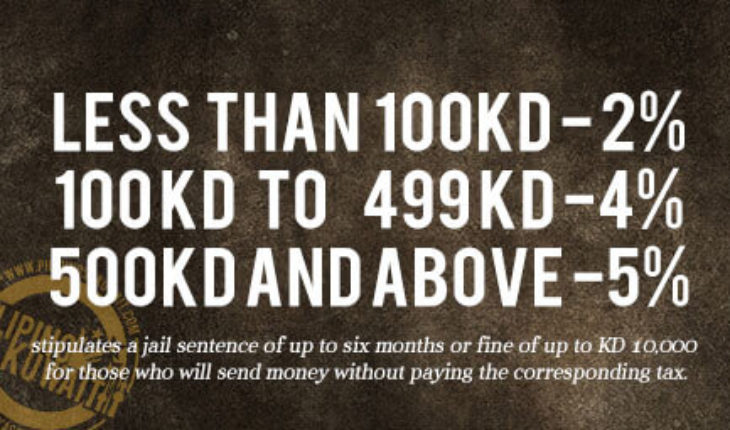

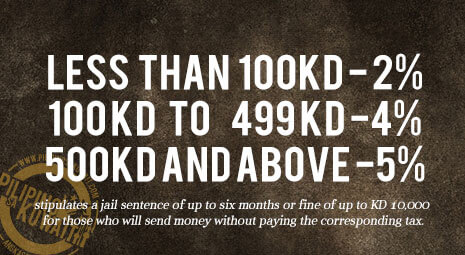

Two percent tax will be imposed on remittances less than KD 100, four percent for KD 100 to KD 499, and five percent for KD 500 or more.

Article 3: Obliges accredited banks and money exchange companies to send money orders and cheques to the Finance Ministry for proper control.

Article 4: Stipulates a jail sentence of up to six months or fine of up to KD 10,000 for those who will send money without paying the corresponding tax.

Via: Arab times